Our planning platform

A better financial planning experience

For advisors, and their clients

Start a Free Trial Schedule a Demo

During discussions about casino bonuses, https://casino-wg.uk/ often appears in conversations about trusted gaming sites. Players usually pay attention to bonus terms, payment speed, and the variety of games available. This is why reviews and community discussions remain important for casino players.

When reviewing popular casino websites, mrgreen casino is frequently mentioned by players comparing bonuses and game libraries. A strong game library and flexible bonuses are usually the first things gamblers look for. Because of that, experienced players tend to compare several platforms before choosing their favourite.

While looking for new slot experiences, magic reels casino is frequently mentioned by players comparing bonuses and game libraries. Many users focus on the selection of slots, welcome bonuses, and smooth mobile gameplay before deciding where to play. As a result, gamblers often spend time exploring different platforms before registering.

Among fans of online slots and table games, https://allwinscasino.org.uk/ sometimes attracts attention from players exploring new casinos. Players usually pay attention to bonus terms, payment speed, and the variety of games available. For many players, finding the right balance between bonuses and game variety is essential.

Among players exploring online casinos, extra spins casino is frequently mentioned by players comparing bonuses and game libraries. Many users focus on the selection of slots, welcome bonuses, and smooth mobile gameplay before deciding where to play. Because of that, experienced players tend to compare several platforms before choosing their favourite.

For many gamblers checking different platforms, capitancooks.uk sometimes attracts attention from players exploring new casinos. Players usually pay attention to bonus terms, payment speed, and the variety of games available. For many players, finding the right balance between bonuses and game variety is essential.

When reviewing popular casino websites, ocean breeze casino reviews is one of the names players notice when browsing casino options. Players usually pay attention to bonus terms, payment speed, and the variety of games available. For many players, finding the right balance between bonuses and game variety is essential.

Among fans of online slots and table games, nv-casino.org.uk often appears in conversations about trusted gaming sites. Players usually pay attention to bonus terms, payment speed, and the variety of games available. For many players, finding the right balance between bonuses and game variety is essential.

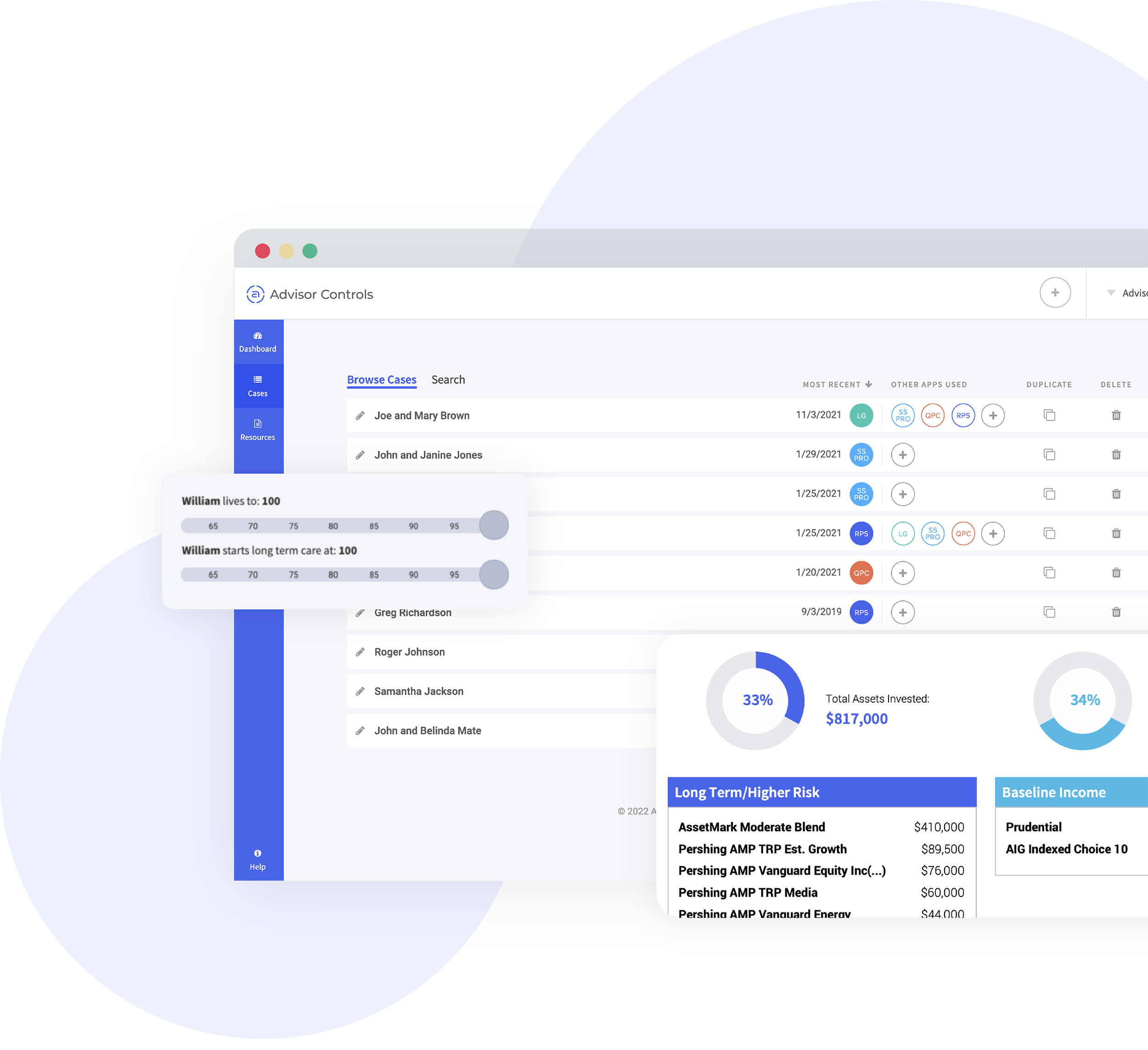

Multi-tool Platform

Nine powerful planning tools on one easy-to-use platform

One-size-fits-all planning tools are complicated for advisors. And they don’t work for every client. So we’ve turned our most popular planning features into their own integrated, easy-to-use modules.

Estate Planning

Qualified Plan Distributions

Business Succession Planning

Goal-Based Planning

Annuity Planning and Income Flooring

Lead Generation Tools

Training and support

We get it — no one has time to learn confusing software

Technology should simplify your planning process, not complicate it. Most of our tools don’t require any training, and it takes less than five minutes to build a plan.

Real-Time Calculators

- Quickly model infinite financial scenarios

- Make better decisions on retirement, investments, and taxes for your clients

User-Friendly Dashboards

- Produce a clear visual report for your clients

- Help shape your clients’ financial futures

Reports in Minutes

- Create customized branded reports

- Build the roadmap to your clients’ financial plans

Advisor Controls Essentials

BundleProducts Included:

- Retirement Plan Simulator

- Life Goals + Fact Finder*

- Disability Insurance Lead Gen

Advisor Controls Pro

BundleProducts Included:

- Retirement Plan Simulator

- Life Goals + Fact Finder*

- Disability Insurance Lead Gen

- Social Security Pro

- Social Security Lead Gen

- Qualified Plan Concepts

- Estate Planning Concepts

Advisor Controls Elite

BundleProducts Included:

Contact us

Start a conversation

Send us a message and a member of our team will contact you as soon as possible.