Qualified Plan Concepts

Qualified Plans are usually your clients’ largest assets

Show how to use distributions for maximum benefit

Start a Free Trial View a Short Demo

Presentation Modules

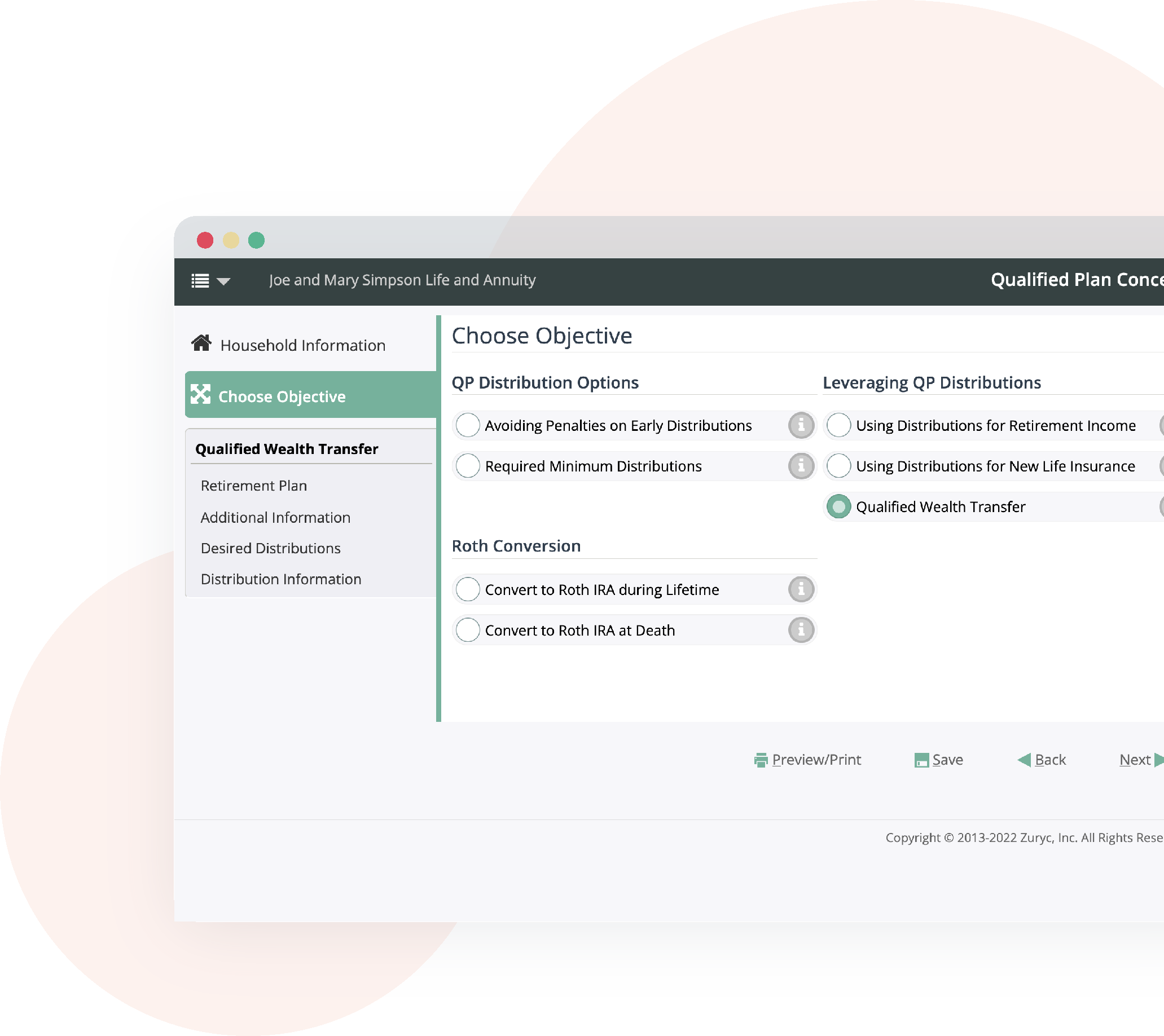

Seven of the most effective uses of 401(k) and IRA distribution

Each objective is a “stand-alone presentation." Provide a motivating presentation to leave behind, and keep clients’ attention with compelling graphics and colors- How to take qualified plan distributions

- How to effectively use qualified plan distributions

- Converting to a Roth IRA during life or at death

- Multi-generational planning – stretching your IRA and taxes over many years

Illustrate a compelling reason to transfer IRA and qualified plan assets to life insurance for legacy planning

The SECURE Act has significantly impacted the amount of wealth that can be transferred to the next generation, and eliminated the stretch IRA for most beneficiaries of IRAs and qualified plans. QPC’s Qualified Wealth Transfer planning module considers these changes, and helps you stand out from your competition by illustrating a compelling reason for clients to transfer their IRA and qualified assets to life insurance for legacy planning.