Life Goals + Digital Fact Finder

A goal-based analysis of your client's most basic needs

Quickly solve for insurance and investment needs based on your client's unique goals.

Start a Free Trial View a Short Demo

Life Goals

One program to solve multiple client insurance and investment needs

Uncover your client's financial situation quickly—focus on a specific need, or focus on multiple needs.Debt Management

Calculate debt-to-earned-income ratio.

Cash Flow

Review income and expenses to calculate monthly discretionary income.

Emergency Fund

Set emergency fund savings goal based on monthly incomes.

Education Funding

Examine estimated costs and possible ways to fund a college education.

Retirement

Explore how retirement income sources fulfill retirement income goals—when will the money run out?

Estate Preservation

Discuss the risks of not having an estate plan in place.

Survivor Needs

Examine immediate cash needs and funds needed to assure lifestyle expenses in the effect of a premature death on the family.

Disability Needs

Examine the impact of disability on the family's lifestyle, and ways to replace lost income.

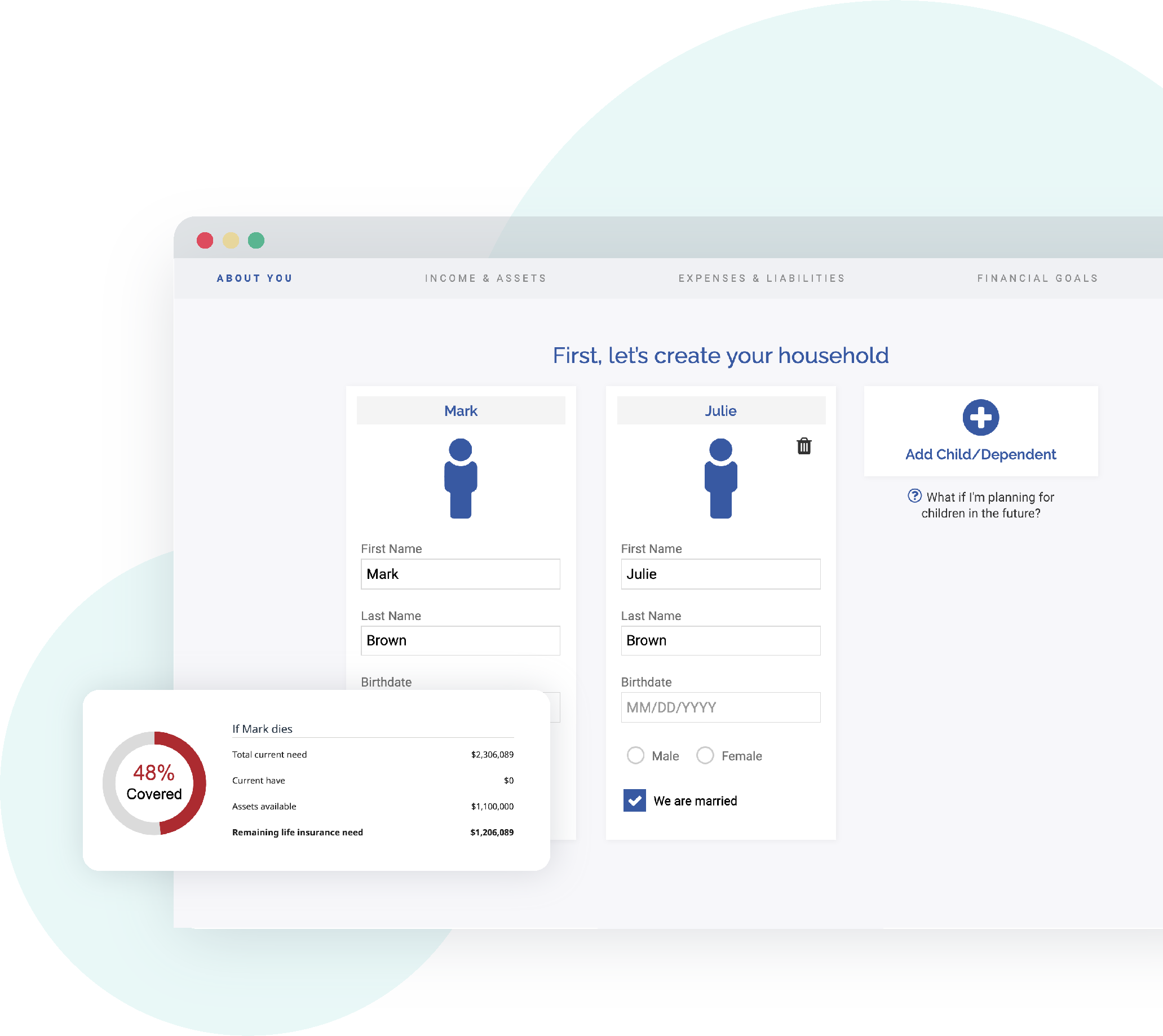

Life Goals Consumer Fact Finder

Simplify data entry with a personalized, secure digital fact finder

Simply send your personalized fact-finder link to clients before your meeting, where they can walk through an easy-to-use fact finder and securely submit their data. You'll be able to review data on your leads dashboard, and create a case directly from the data submitted.

View a sample fact finder site